Buying your dream home is a long-term investment that gives you pride in ownership. Homeownership shields you from high tax rates through mortgage interest deductions, building equity. You can also benefit from capital gains exclusion, but only if you meet the ownership and use test. Owning a home allows you to enjoy preferential tax treatment. You can finally customize it as you desire to bring out your style and taste.

Buying a home involves high upfront costs and also includes maintenance costs. Since most of your payments in the early years of a mortgage go to interest, your equity doesn’t immediately grow until property values within your locality increase. Thanks to local conditions and poor maintenance, your home’s value may depreciate over time, reducing your return on investment. Here are 10 things to consider when buying a home.

Cost of owning a home

Owning a home involves not only monthly mortgage payments but also other hidden costs. The cost of buying a home includes property taxes which are guaranteed payments in perpetuity, and they vary by locality and state. If you buy a home within a condominium association or homeowner’s association, you’ll have to pay a quarterly or monthly fee for costs like snow plowing and garbage collection.

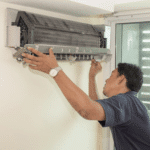

You also pay for homeowner’s insurance, which is subject to an annual increase and can also go up when your property value increases. You may incur other upkeep and repair costs, including roof repairs, faulty electrical system repairs, and plumbing. Additional costs of owning a home include lawn care and landscaping and repairing and maintaining the HVAC system.

Down payment

The down payment required to buy a home is usually high, creating an obstacle for many homebuyers, especially first-time buyers. The minimum down payment for a home may depend on the price of the house, the type of property you’re buying, and the mortgage program. You can pay the down payment from your savings, sale of assets, down payment assistance programs from government agencies, non-profit organizations, and employers.

While making a large down payment may be a good option, it isn’t always a good idea because it may deplete your emergency fund, leaving you vulnerable to unforeseen financial problems. If you have high-interest debt, avoid using your savings to cater for a large down payment. Consider reducing the debt so you can pay less interest on your mortgage loan. You can also find other ways to buy a home with less money than you have.

Interest rates

Interest rates play a crucial role in determining your monthly mortgage payment size, and getting a low-interest rate on your loan can be beneficial for you. The factors affecting your interest rates include credit score, home location, and price and loan amount. The amount of down payment needed also determines your interest rate. The loan type and loan term also affect your interest rates, and the type of interest rate involved, whether fixed or adjustable, impacts your overall rate.

Time of the year

If you want a variety of homes to choose from, spring could be the best time to buy your dream home. Buying when the sellers are experiencing less traffic (winter) can be an excellent time to house hunt as you can have a price flexibility advantage. You may also consider buying during the off-season period within your area. Look for sellers who offer discounts, especially during holidays, to land yourself a quick, fair deal.

Know your monthly costs

When preparing your monthly budget, it’s essential to include all potential costs to know what to expect and if you can afford it. Add insurance premiums, property taxes, utility bills, and any other recurring expenses. Consider the long-term financial commitment so you can adequately prepare your finances.

Choosing a high-taxed home requires continuing commitment which may strain your finances. In addition, buying a more expensive home that is well-maintained can earn you low-interest rates and less expected repair costs.

How long you intend to stay

Before buying a home, it’s essential to consider how long you intend on staying there. The duration of stay helps you determine whether buying is a good idea or you should just rent. While it may be challenging to determine how long you can live in a place, predicting it can help you make wise financial decisions. If you intend on selling the home later on, determine how much time your home needs to break even, as this plays a vital role in determining your return on investment.

Job security

Job security determines whether you can stick to mortgage payment schedules. Although job security may be the last thing on your mind when buying a home, considering it ensures that you don’t face legal issues or lose your home for failing to honor your payments. Before you commit to paying mortgage premiums and all other costs involved, ensure your job’s security so you can organize your finances to meet your obligations.

Your debt-income ratio

Mortgage lenders rely on the debt-income ratio to ascertain whether you can afford the monthly payments for the property you intend to buy. Determine how you’ll be making your mortgage payments and settle for what you can afford. Study your finances and consult a financial advisor if necessary to ensure the home you buy doesn’t exceed your debt-income ratio of 43%. Note that if your debt-income ratio exceeds the set percentage of your income, it may be hard to secure a mortgage for the property you wish to buy.

Demand and supply

When home prices appreciate, many homebuyers find it difficult to buy within their financial reach. First-time home buyers find it more difficult due to low starter homes supply. Thanks to increased home prices and rent combined with stagnant wages, the real estate market can experience a mix of low supply and increased demand, making it hard for first-time homebuyers.

The home inspection report

When buying a home, it’s essential to go through the home inspection report. This is because inspections can uncover severe issues like rot, roof damage, poor insulation, mold, outdated wiring, roof damage, and more. Being aware of these issues helps you decide whether to buy or continue shopping for better options.

Endnote

Buying a home is a significant investment. However, it’s essential to familiarize yourself with all the hidden costs and other considerations to avoid costly mistakes and financial issues later.